How the Maharashtra elections could influence the Indian stock market?

The summary clearly analyzes how the Maharashtra elections could influence the Indian stock market. It touches on crucial points:

-

Policy Continuity vs. Uncertainty: Markets favor predictability. A BJP-led victory will likely ensure ongoing policies focused on infrastructure, which investors see positively. Conversely, shifting to Congress-led governance might introduce temporary uncertainty as markets evaluate potential policy changes.

-

Sectoral Shifts: Maharashtra's economic importance means election outcomes could directly impact key sectors. For instance, infrastructure and real estate might react based on government priorities and policy directions.

-

FPI Activity and Market Trends: The pullback by FPIs in recent months highlights global factors, but local political clarity—especially favoring business-friendly governance—could help stabilize market sentiment. Broader global market trends remain critical in shaping overall movements.

ALSO READ, Benefits of Tax planning and rebates with suitable investments.

To refine the analysis further, here’s a more nuanced breakdown of how Maharashtra elections could influence the Indian stock market:

1. Policy Continuity vs. Uncertainty

- A BJP-led victory is expected to maintain policy continuity, emphasizing infrastructure growth and industrial expansion. This consistency could enhance investor confidence, particularly in sectors like real estate, construction, and heavy industries.

- Conversely, if the Congress-led alliance assumes power, markets may react cautiously as investors assess potential shifts toward rural welfare and social spending. These changes could lead to delays in infrastructure projects and affect capital-intensive sectors.

2. Sector-Specific Impacts

- Maharashtra is one of India's largest industrial states, contributing significantly to the GDP. The election's outcome could directly influence:

- Infrastructure Projects: A BJP win might accelerate these projects, boosting industries reliant on government contracts.

- Agriculture and Rural Development: A Congress win may lead to increased spending in rural areas, benefitting agricultural inputs and FMCG sectors.

3. Market Volatility and Global Factors

- Short-Term Volatility: Election-related speculation often drives temporary swings in market indices. However, these impacts typically stabilize after policy directions become clearer.

- Foreign Portfolio Investors (FPIs): With FPIs withdrawing significant funds recently, the election's outcome may either deter or attract further investments, depending on its perceived impact on economic policies.

- Global Market Trends: Broader factors, such as U.S. interest rates and international economic trends, are likely to have a larger long-term influence on the Indian markets.

- Global and Domestic Interplay

- Global Markets: The influence of the U.S. Federal Reserve’s interest rate decisions and geopolitical tensions may overshadow local political developments in shaping FPI behavior and market sentiment.

- Corporate Earnings: Investors are equally focused on corporate earnings, which provide a more direct reflection of economic performance. This limits the long-term influence of state-level elections on overall market trends.

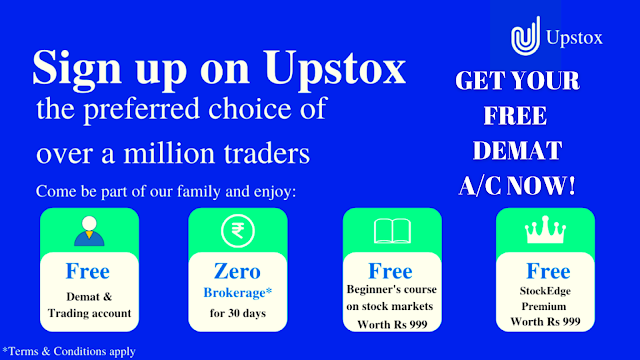

GET YOUR FREE DEMAT A/C NOW.

Upstox 3-in-1 (Trading, Demat, Savings) account.

Here’s an advanced sector-specific and strategic breakdown of how the Maharashtra elections could impact the Indian stock market:

1. Short-Term Market Sentiment

- Speculative Volatility: Historically, election results often drive immediate market reactions, influenced by speculative trading. Investors may anticipate changes in policy directions, leading to fluctuations in stock prices, particularly in state-centric sectors like real estate and infrastructure.

- Event-Driven Reaction: A BJP victory might trigger a short-term rally in stock prices due to perceived policy continuity, while a Congress win could lead to cautious investor sentiment pending clarity on new policies.

2. Sector-Specific Analysis

- Infrastructure and Real Estate: Maharashtra's capital, Mumbai, is a financial hub with ongoing mega infrastructure projects like the Mumbai Coastal Road and the Metro Rail expansions. Continuity in governance could accelerate these projects, benefiting companies in the construction, cement, and ancillary sectors.

- Banking and Finance: Banks and NBFCs with significant exposure in Maharashtra might witness volatility, especially if policies related to rural credit or farm loans are revised under new leadership.

- Consumer Goods and FMCG: A shift in focus towards rural welfare and subsidies by a Congress-led government could boost rural consumption, benefitting FMCG companies and agri-focused firms.

3. FPIs and Broader Trends

- Foreign Portfolio Investor Impact: The recent withdrawal of funds by FPIs underscores global concerns like U.S. interest rate hikes and geopolitical risks. A stable and investment-friendly mandate in Maharashtra may marginally counteract this trend, particularly for sectors with high FPI interest.

- IPO Market: Political stability post-elections might also influence investor confidence in the IPO market, which has shown resilience despite recent FPI outflows.

4. Investment Strategy Insights

- Long-Term Investments: Sectors like infrastructure and housing are better suited for long-term gains, contingent on continued policy support.

- Defensive Sectors: Given uncertainties, investors may pivot towards defensive sectors such as IT and pharmaceuticals, which are less reliant on local political outcomes.

- Thematic Plays: Post-election announcements could create thematic investment opportunities, such as renewable energy or electric vehicle policies, depending on the government’s agenda.

ALSO READ: What to do when stocks are going down? | Bear market strategy

Conclusion:

The Maharashtra elections represent a key event for local market sentiment, especially due to the state's economic significance. However, their overall impact on the stock market will likely remain secondary to global economic factors, corporate earnings, and national policy directions.

Your overall conclusion—that elections contribute to market sentiment but are less impactful than global and broader domestic policies—is well-supported by expert opinions.

Let me know if you'd like an even deeper dive into any particular sector or issue! Comment below.

Through this article, we try to give you a fresh perspective to enhance your understanding of financial markets. Whose advice did you like the best, tell us in the comments, and don't forget to subscribe to the Dev Invest Notes.

We will bring back such interesting videos for you soon.

Happy investing. Bye!

THANK YOU

GET YOUR FREE DEMAT A/C NOW.

Upstox 3-in-1 (Trading, Demat, Savings) account.

Comments

Post a Comment