These three valuation ratios are quite useful to measure how expensive a stock is.

In the exchange, identifying a decent business isn't enough; buying the stock at the proper valuations is the maximum amount important. Valuing a business means assessing its worth in order that you'll be able to know if the worth you're visiting acquire it's reasonable. Smart investors want to shop for a business available at but what it's worth. If you pay an excessive amount of for the stock, regardless of how good the business, it's likely that you simply won't make meaningful returns or, worse, lose money.

How does one assess valuations? While there are some tools available to assess valuations, there's nobody definite formula that you simply can apply to any or all cases. In fact, valuation criteria may vary from industry to industry. as an example, while it's okay for FMCG stocks to trade at comparatively high multiples, metals and mining stocks tend to trade at low multiples.

Assessing valuations is additionally a matter of analytical judgement. you cannot always tell whether you're paying the proper price. for example, a debt-laden company is also available at cheap valuation multiples and an organization with good earnings visibility may tend to trade at high valuations. Hence, valuations cannot be seen in isolation; they must be viewed in conjunction with the standard of a business and its various intrinsic aspects.

Valuations also vary with the economic potential of a rustic. a rustic with high growth rates and political and economic stability will have higher valuations than a rustic which is struggling to carry itself together. A developed market, just like the US, will trade at high valuations, given its economic stability.

Overall, assessing valuations is like buying vegetables: you would like to shop for the nice ones at an affordable price; you do not want to shop for the bad ones cheap, and you avoid buying good ones at exorbitant prices.

Here are three popular valuation tools which will facilitate your get a thought of how expensive a stock is:

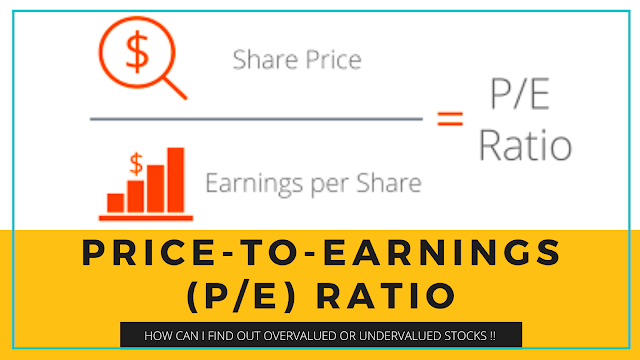

Price-to-earnings (P/E) ratio: The P/E ratio is probably the foremost widely used valuation measure. It tells you what you're paying for each rupee of a company's earnings. If you purchase a stock at a P/E of 10, it means you're paying Rs 10 for the company's earnings of Rs 1. Naturally, you may want to pay as less as possible. But here may be a word of caution. As stated above, study the business before applying this valuation measure thereto. a coffee P/E doesn't always indicate a bargain and a high P/E doesn't always signal expensiveness.

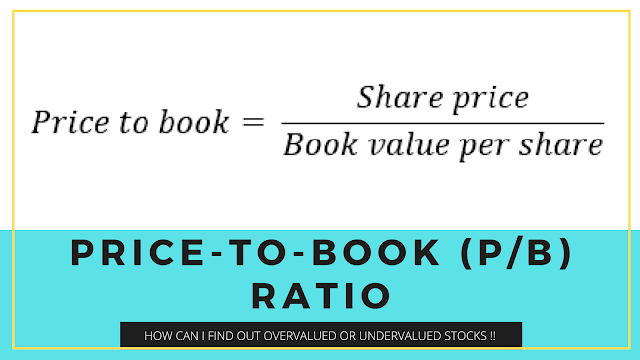

Price-to-book (P/B) ratio: The P/B ratio tells you ways expensive a stock is in reference to its worth on the company's books. A P/B ratio of over one implies that the stock is quoting at a premium to its actual worth.

Both a high P/B and an occasional P/B should be explored. do not get too excited to search out a stock trading below book. Such a stock may well be a 'value trap', i.e., it's cheap valuations are thanks to its bad fundamentals. On the opposite hand, sometimes the value doesn't capture verity worth of a company's assets, which may make the P/B look artificially high.

The P/B ratio is very useful within the case of banks and non-banking finance companies.

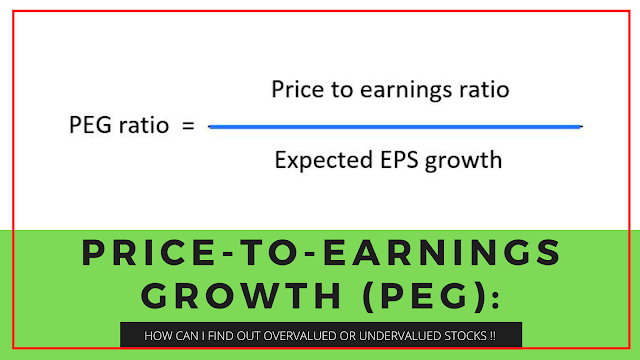

Price-to-earnings growth (PEG): The PEG ratio is an improvement on the standard P/E ratio. Popularised by the legendary investor Peter Lynch, it factors within the earnings rate of growth. it's obtained by dividing the P/E ratio by the earnings rate of growth. A PEG of but one is taken into account attractive.

HAPPY LEARNING !!

© copyright 2020 – All rights reserved

Comments

Post a Comment